- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

How to Conduct a Connecticut Business Entity Search

- How to Conduct a Connecticut Business Entity Search

- Allowable Entity Types in Connecticut

- Why Search for a Connecticut Business Entity

- How to Search for Business Entities

- How EntityCheck Helps You Research Business Entities

- Alternative Resources Beyond the SOS (Secretary of State) Search

- How to Find the Owner of a Business Entity in Connecticut

- Additional Resources for Business Ownership Info

- Types of Owners and Their Roles

- Red Flags to Look for When Searching Business Entities

- Best Practices When Reviewing Business Entity Records

- How to Register an Entity in Connecticut

- How Much Does It Cost to Start a Business in Connecticut?

- FAQs

- EntityCheck in US States

Connecticut is home to over 360,000 small businesses. That number represents 99.4% of all companies in the state. These businesses are registered through the Connecticut Secretary of the State's office, which maintains a searchable database for registered entities. These small businesses employ 741,920 Connecticut residents. The state has a Connecticut Business Registry Search, also known as the CT Business Lookup Tool, which allows the general public to find registered business entities.

Registering a business in Connecticut offers some advantages, such as limited liability protection that shields personal assets and various tax incentives and credits, particularly for new companies and those in designated Enterprise Zones. Other benefits include a flexible management structure for LLCs, a talented workforce, and strong state support services. LLCs in Connecticut have fewer formalities (no meeting minutes or resolutions) than corporations, making them easier to run.

New businesses may be eligible for a 10-year corporate business tax credit. Connecticut offers a tax credit program for R&D activities. Companies located in designated Enterprise Zones can receive additional benefits, such as a 10-year corporate tax credit, a 5-year 100% tax exemption on new manufacturing equipment, and sales and use tax relief. Businesses may qualify for an insurance reinvestment tax credit, which can be an added financial benefit.

The most common types of businesses in Connecticut include healthcare and accounting services, retail, and general construction. While these are common sectors, Connecticut is also home to major industries such as advanced manufacturing, aerospace, and bioscience, which employ a significant number of people. Connecticut is also well-known for its insurance industry, with many companies headquartered in the state.

Allowable Entity Types in Connecticut

Connecticut allows people to form several different business entity types, including Sole Proprietorships, Partnerships, Limited Liability Companies (LLCs), and Corporations (C-corporations and S-corporations). Other options available are Non-profits, Benefit Corporations, Limited Partnerships (LPs), and foreign/alien corporations, which can be structured as corporations or LLCs. The best choice depends on factors such as liability, taxation, and the number of owners, so it's essential to consult a professional to help you decide.

The most common business entity type in Connecticut is the Limited Liability Company (LLC), due to its flexibility and the personal asset protection it offers to owners. LLCs are a good middle ground, blending the liability protection of a corporation with the tax flexibility and simpler operations of a partnership.

Why Search for a Connecticut Business Entity

People search for Connecticut business entities for various reasons. One of the most common reasons is to ensure their chosen business name is unique and complies with state naming rules. Another top reason to search is to verify the status and details of an existing company. This search is crucial for legal compliance, preventing expensive rebranding or trademark disputes, and for conducting due diligence for partnerships or investments.

Some key reasons to search for a Connecticut business entity include:

Name Availability: To ensure your desired business name isn't already in use, which is required by law, and prevents future confusion or legal issues.

Legal Compliance: To verify that a business is operating legally and is in good standing with the state, which is necessary for official transactions.

Due Diligence: To research potential partners or investments by checking their corporate information, status, and history.

Verify Company Details: To find information like the principal and agent details, filing history, and current status of an entity.

Obtain a Certificate: To see if a business is eligible for a Certificate of Legal Existence, which verifies it is up to date on all filing obligations and is often required for loans.

Finding Information: You can find official information on registered businesses, including their legal structure, which can be helpful in various business-related decisions.

Prevent Legal Issues: Searching for an existing entity helps you avoid legal battles over trademark infringement and other name-related disputes.

Ensure Tax Compliance: A unique business name is crucial for tax purposes, as it ensures your business is correctly identified and associated with its tax obligations.

Confirm Registered Agent Information: Use the search to find the registered agent for an existing company.

Investigate Potential Partners or Competitors: Researching a company can help you understand its history, structure, and regulatory compliance before making a business decision and jeopardizing your own company.

Find a Business Owner: If you know a founder's name, you can search for all the businesses they have been involved with.

Compliance: To check to see if a company is compliant with all local, state, and federal regulations.

Name Reservations: To see if a preferred name is available to be reserved for a limited time, which can help secure a domain name and other branding elements while preparing to register the business formally.

Before Investing: Conducting thorough due diligence when acquiring or investing in a business.

Trademarks: Searching for registered trademarks to avoid conflicts.

How to Search for Business Entities

To search for Connecticut business entities, visit the Connecticut Secretary of the State website and launch the Business Records Search and choose your search criteria.

Typically, you can search for a Connecticut business entity using any of the following criteria:

Business Name: Enter the entity's partial or complete name.

Principal Name: Enter the last and/or first name of the principal officer. If the principal is a business entity, check the "My principal is a business" box and enter that business name.

Filing Number: Enter the filing number of the business entity if you know it.

Business Address: Enter the business address if known.

Business ALEI: Enter the Authoritative Legal Entity Identifier (ALEI), a unique identifier assigned to a business by the government when formed.

Agent Name: Enter the first and/or last name of the agent if known. If the agent is a business, select the "My principal is a business" box and provide the business name.

Business City: Enter the registered city in which the business entity operates.

Review the search results.

What Information Can You Find with the Secretary of State?

Typically, the Business Record Search page will ask you to enter the business name, filing number, or business ALEI to search. However, you can use the "Advanced Search" option to search using other criteria, especially if you require something more specific.

Once a search criterion is decided and entered in the appropriate field, click the "Search" tab. The search will return a list of all business entities that match the search criteria. The listed search results will display the business name, address, agent's name, principal's name, ALEI, and the business's current status at a glance.

Besides business entity search, the Connecticut Secretary of the State website has a lot more information, including the following:

Start Your Business: For individuals who want to start a new business and learn how to find funding for their business

Services: Information on filing annual reports, all business filings, updating business details, and employment services

Taxes: Tax guides, filing and paying taxes, IRS small business tax center, and business tax incentives

Licenses and Permits: Looking up business licenses, renewing business licenses, and environmental compliance

My Industry: Doing business in Connecticut, manufacturing, key industries, and agricultural business assistance

Resources: FAQs, small business Administration, and business resources

How to Access Detailed Information

When you select a business name from the listed search results, you will generally gain access to its detailed record. This includes the basic info shown in the search result (such as the entity's name and status), plus more expanded sections like:

General Information: Business name, status, address (including mailing), ALEI, formation date, business type, annual report due date, and date of last report filed

Principal Details: Name, title, and address (residence or business) of the principal officer or business

Agent Details: Name and business, residence, and mailing address of the registered agent

Annual Filing Reports: Filing dates and times for each year the business has submitted a report

Name History: Any historical name changes

Shares: Information about issued shares, if applicable

You may contact the Secretary of the State Office if you encounter any challenges navigating the Business Records Search page or need further assistance with searching for a registered business entity in Connecticut.

What Business Entity Information is Not Public

Although some information, like business name and entity type, formation date, filing history, registered agent, and basic business contact information, is public, in Connecticut, public business records generally do not include internal, sensitive, or private data, such as employee information, trade secrets, or the personal details of owners or members. Information considered private under Connecticut law, such as racial or ethnic origin, health conditions, sexual orientation, or religious beliefs, is not part of public business records.

LLC Managers/Members: Names, addresses, Social Security numbers, and other personal details of LLC managers or members.

State and Federal Tax IDs: The Employer Identification Number (EIN) and other tax identification numbers are not public information.

Sensitive Personal Data: As defined by the Connecticut Data Privacy Act, any information that reveals an individual's racial or ethnic origin, religious beliefs, health status, sexual orientation, or other similar sensitive data is not public.

Trade Secrets: Formulas, processes, methods, or other proprietary information that derives economic value from not being generally known to the public and is the subject of reasonable efforts to maintain its secrecy.

Private Employee Medical Records: Medical and health insurance information.

Customer and Employee Identifying Information: Identifying information like Social Security Numbers, driver's license numbers, and passport numbers.

Revenue and Profit Numbers (unless a public company): Smaller companies that are not publicly traded can keep their financial data private.

Financial Data: Bank and credit card numbers, as well as loan information.

How to Find EIN and UCC Records in Connecticut

You can find a company's EIN in Connecticut by checking the Connecticut Secretary of the State's website, where it is often listed in the business's annual reports or filings. If the company is publicly traded, search the U.S. Securities and Exchange Commission (SEC) database for the EIN in its filings, such as the 10-K or 10-Q reports. You can also try requesting a completed Form W-9 from the company, check a business credit report, or contact the company directly.

Consider EntityCheck's EIN Lookup tool to find a company's tax ID.

To find UCC records in Connecticut, visit the CT.gov business services website at business.ct.gov and use the "Business Records Search" tool to search for the debtor's name. You can also access UCC data and images through the bulk data and images section on the CT.gov site if you need to search large volumes of data.

EntityCheck also offers a UCC Filings search tool.

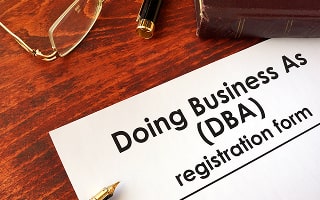

How to Find DBA Records in Connecticut

To find DBA (Doing Business As) records in Connecticut, you can use the online search tools on the Connecticut Secretary of the State's website and the individual town clerk's websites where the DBA was filed. The Secretary of the State's online business search provides statewide results for registered entities, while town-specific searches are necessary for local trade name registrations.

How EntityCheck Helps You Research Business Entities

An even more insightful way to search for Connecticut business entities and access additional information is to utilize EntityCheck's powerful search engine. Search quickly and easily by business name, EIN, owner, phone number, or email address. Along with the information above, you can dig deeper to find incredibly illuminating details such as:

- UCC Filings

Discover Uniform Commercial Code (UCC) filings, showing creditors' attachment to business assets. These files provide insight into the organization's financial stability by examining its standing debts and the risks they entail. Also find lien details, creditor and debtor information, filing and expiration dates, and collateral and asset claims.

- Court Cases

Evaluate a company's legal record to assess potential risks associated with its operations and identify any outstanding issues. Review bankruptcy filings, liens and judgments, federal court cases, litigation, and legal history of ongoing and past court cases.

- Licenses

Verify business credentials, including licenses, permits, and government certifications, as well as the educational backgrounds of decision-makers, to assess credibility.

- Filing & Compliance

Review a company's financial performance reports, DBAs, and government Tax IDs.

- Trademarks & Patents

Find out what intellectual properties a company controls and review the details of any trademarks and patents it holds.

- Registered Individuals

Identify key decision-makers, registered agents, corporate officers, and leadership, even if this information is not readily available through official records.

Alternative Resources Beyond the SOS (Secretary of State) Search

Acting as the central business data repository, the Secretary of State's office is a valuable resource for information, but it's not the only one. The government agencies listed below may have specific information about registered Connecticut business entities in their files:

The Connecticut Secretary of the State (SOT): The Connecticut Secretary of the State is responsible for administering elections, overseeing business filings, and managing the state's public records and documents. The office's duties include maintaining the official records of corporations and business entities, ensuring fair and impartial elections, and providing services like authenticating documents and registering notaries public.

The Connecticut Insurance Department (CID): The Connecticut Insurance Department (CID) regulates the insurance industry to protect consumers, ensure fair competition, and promote the availability of insurance products. It fulfills its mission by enforcing state laws, monitoring the financial health of insurance companies, investigating fraud, and assisting consumers with claims and complaints. The department also provides resources like consumer alerts and information on state regulations.

The State of Connecticut Department of Banking (DOB): The State of Connecticut Department of Banking (DOB) regulates financial institutions, enforces state laws, and protects consumers from unlawful practices in banking, securities, and consumer credit. It achieves this through regular examinations of supervised entities, licensing and registration of firms and individuals, and consumer outreach and education. The department also handles applications for new banks, mergers, and acquisitions, and provides resources for consumers, such as educational materials, alerts, and assistance with complaints.

The Connecticut State Department of Revenue Services: The Connecticut Department of Revenue Services (DRS) is responsible for collecting state taxes. Its online portal allows people to file tax returns, make payments, and view filing history. The Department of Revenue Services (DRS) provides a list of information for business owners on registering a business and business taxes.

The United States Small Business Administration (Connecticut District): The U.S. Small Business Administration (SBA) is a federal agency that helps Americans start, grow, and build businesses by providing access to capital, contracting opportunities, and free counseling. It also offers disaster assistance and acts as an advocate for small businesses in Congress.

Check with each of the organizations above to find additional information on Connecticut businesses.

How to Find the Owner of a Business Entity in Connecticut

To find the owner of a business entity, first try an internet search using a reliable search engine. You should generally find results containing information about the business's principal officers. They will primarily include the executive and non-executive directors of such a business entity. However, this kind of search is unlikely to reveal a clear or detailed picture of the entity's ownership and legal structures. You may need to search a state government database of registered businesses to access more comprehensive information about their owners.

Generally, looking up a business entity on the Connecticut Secretary of State's Business Records Search page will provide you with detailed information about the company. Such information will include details about its owners and legal structure.

Additional Resources for Business Ownership Info

Some other resources, such as the following, may also help reveal the owners of business entities in Connecticut:

Better Business Bureau: There are instances in which the Better Business Bureau (BBB) publishes profiles of businesses and professional profiles of their owners.

Company's Website: Some business entities may list information about their owners on their websites.

Local Chambers of Commerce: It is standard practice for local chambers of commerce in any state to maintain a database of registered businesses in their area. Databases often include public directories of principal officers of the listed companies.

Department of Revenue Services: The Connecticut Department of Revenue Services (DRS) generally maintains information on business owners in the state.

Other Public Records: Other publicly available records, such as court, real estate, and business license records, may contain information about business entity ownership.

Types of Owners and Their Roles

Business leadership roles in Connecticut are like those in other states, including executive positions such as CEO, CFO, and COO, as well as management roles such as Director of Operations, General Manager, and Regional Manager. You may also see leadership positions in specific functions such as Project Management, Sales, Finance, and Human Resources, as well as in sectors such as technology and retail. The range of roles spans industries including manufacturing, finance, healthcare, and education, which are prominent in Connecticut.

The available ownership/leadership roles in Connecticut include:

Executive and Senior Leadership

Chief Executive Officer (CEO): The highest-ranking executive who makes final management decisions.

Chief Operating Officer (COO): Oversees daily operations and administrative functions.

Chief Financial Officer (CFO): Responsible for a company's financial actions.

Chief Marketing Officer (CMO): Leads a company's marketing efforts.

Chief Technology Officer (CTO): Manages technology and digital infrastructure.

Management and Operations Leadership

Director of Operations: Leads and oversees various operational aspects of the business.

General Manager: Oversees a specific business location or division.

District Manager: Manages a group of stores or branches in a specific geographic area.

Plant Manager: Manages a manufacturing facility.

Project Manager: Guides projects from initiation to completion.

Functional Leadership

Director of Sales/VP of Sales: Leads the sales team and develops sales strategies.

Finance Director: Leads financial planning and analysis.

Human Resources Director: Manages employee relations, recruitment, and training.

Director of Technology & Innovation: Leads the development of new technologies.

Other Prominent Leadership Roles in Connecticut

Business Manager: Manages the finances and operations of a specific business or department.

Learning and Development Director: Oversees employee training and development programs.

Executive Director: Often found in non-profit organizations or specific public services, with a role similar to a CEO.

Regional Manager: Oversees operations in a specific geographic region.

Different entity structures have various roles and types of ownership. Some individuals who have control over a company may not hold a traditional role within it. Leadership is a crucial factor to understand before working with a company. Connecticut also has some specialized roles, such as Business Analyst, Actuarial Analyst, PR Manager, and Corporate R&D Chef.

Some of the more conventional roles within companies include:

Shareholders (or Stockholders): They own the corporation by purchasing stock, which grants them voting rights to elect the Board of Directors and influence major corporate decisions.

Directors: Directors set the strategic course for the corporation, make major decisions, and oversee the conduct of the officers.

Officers: Officers, such as presidents (CEO) and secretaries, manage the day-to-day operations of the business and are hired and fired by the Board of Directors.

Members: Members are the owners of the LLC. They can also serve as managers or delegate management to others. Members are typically protected from personal liability for the company's debts.

Managers: Managers, whether members or non-members, are responsible for managing the business and affairs of the LLC.

General Partners: They manage the business affairs as outlined in the partnership agreement. General partners are entirely liable for all business debts and obligations.

Limited Partners: Limited partners have limited management rights. Their liability is typically limited to their investment in the business, providing them with some protection from business debts.

Red Flags to Look for When Searching Business Entities

When searching Connecticut business entities, look for red flags such as delinquent or overdue filings on the Connecticut Business Services website and an unclear or absent online presence. Other warning signs include the use of generic email addresses, vague company names, a lack of physical premises, and a history of management-related losses or conflicts of interest. It's also important to be wary of companies that offer lucrative investment opportunities but have a history of management with criminal or disciplinary issues.

Some general red flags to watch out for include:

No Professional Website: May indicate an unprofessional or less established business, though not always a red flag.

Lack of Professional Affiliation: A business that is not affiliated with industry organizations may be less reputable or less established.

Negative Customer Reviews: Consistent negative feedback can highlight issues with the business's products, services, or customer relations.

Poor News Coverage: Negative press can signal significant problems, such as legal issues, financial troubles, or operational failures.

Some more serious issues to look out for include:

Entity Status Problems

Common entity status problems in Connecticut include failing to comply with annual reporting and tax requirements, such as filing electronic withholding forms and paying the Business Entity Tax (BET), as well as difficulties with cross-entity mergers due to complex state laws. Other issues involve navigating state tax laws, especially with the pass-through entity tax, and ensuring compliance with operating documents, which can lead to litigation if ignored.

Check the status of a Connecticut business entity, paying particular attention to "Public Sub Status." A "Red" status (delinquent) indicates action has been taken, while "Yellow" (overdue) means filings are past due.

If there are no public records for a Connecticut entity, that should be a warning that something is not right, and the company may not be legally registered in the state.

Inconsistent or Suspicious Information

Always keep an eye out for missing or inconsistent information. Look for any inconsistencies in the registered agent's name, address, or other details. A lack of clear contact information can be a significant concern.

Another red flag is a misleading name. A business name that is too similar to an existing one or that incorrectly implies government affiliation can be a warning sign that the company is attempting to deceive the public. Be cautious of names that sound reputable but are vague, like "Hartford Business Recognition", especially if they are not easily searchable.

A business with a poorly designed website or that uses excessive grammatical errors and spelling mistakes might also be a red flag.

Suspicious companies in Connecticut have included those involved in nationwide scams, such as the re-shipping scheme involving Inspection Land, LLC, and Dolphin Services, LLC, and fake employment schemes like Groovy USA. Other scams target new businesses, such as the CT Certificate Service, which charge s an unnecessary fee for a "certificate of existence". Additionally, several telecom companies have received warning letters from the state Attorney General's office for their involvement in robocalls, including Global Net Holdings, All Access Telecom, and Lingo Telecom.

Ownership and Management Concerns

Poor management or ownership issues can indicate larger problems. Look for a management team with a history of causing investor losses in previous businesses and stay away from these firms.

The most common employment lawsuits in Connecticut involve wage and hour disputes (like unpaid overtime), wrongful termination (often due to discrimination or retaliation), and workplace harassment. These claims are frequently settled out of court, with help from the Connecticut Commission on Human Rights and Opportunities (CHRO).

Financial and Investment Warning Signs

Check a company's financials for inconsistent financial transactions, a lack of documentation, duplicate payments or invoices, or suspicious cash disbursements. They, too, can indicate fraud or potential criminal activity. Always be on the lookout for requests for unusual payment methods, such as wire transfers, credit cards, or payments to a personal bank account.

Additionally, watch for an unusually high number of transactions, especially around the end of a reporting period, which could be an attempt to inflate sales to defraud the government or the public.

Be aware of companies that have received a substantial amount of "cheap stock" or options, which can lead to immediate and significant dilution for investors. If the offering price for securities appears to have been arbitrarily determined, it is a red flag. Companies that have no plans to pay dividends in the near future are a concern for investors.

Legal and Compliance Issues

Be concerned about material conflicts of interest between management and the company, such as substantial compensation paid to management that benefits them at the expense of investors.

Investigate a company to determine whether its principals or promoters have a criminal record or have faced disciplinary action.

Some of the most common types of business lawsuits in Connecticut involve breach of contract and employment disputes. Other frequent issues include wage and overtime claims, discrimination, and various forms of commercial litigation, such as fraud or intellectual property disputes. Be very careful when entering into any contracts with a company that has a history of breach-of-contract lawsuits.

Connections & Affiliations

A company's connections and affiliations can tell quite a story. Sometimes one person runs multiple dissolved/failed companies. Look for recurring patterns of dissolution followed by new formation. That is a significant indicator of potential fraud. One thing to be cautious of is a company with ties to organized crime figures and politically exposed persons (PEPs). If the company makes a concerted effort to conceal its actual owner or person in charge, that should be a clear warning to stay away.

Some red flags in broader business records include the following:

Inconsistent Public Records

Company filings don't match what's listed in:

Court records

Tax records

Property ownership filings

An example is that the registered address differs from the address listed in lawsuits or liens.

Poor Record-Keeping

Missing meeting minutes (for corporations).

No updated ownership/member list for LLCs.

Lack of transparency in accounting records.

Regulatory Issues

Fines, sanctions, or loss of licenses with state agencies.

Businesses flagged by the Better Business Bureau or the Attorney General's office.

Unusual Patterns

Very recent incorporation with sudden high activity.

Foreign entities registered but not compliant with local laws.

Shell-company indicators (multiple entities tied to the same registered agent at the same address).

Best Practices When Reviewing Business Entity Records

Utilize the best practices outlined below to maximize the benefits of your research. A business background check can take time, but it can yield a wealth of information that could help you avoid any costly mistakes.

Cross-reference everything.

Compare the UCC filing data with records from litigation and bankruptcy courts. Look for discrepancies between the documents.

Check annual reports for consistency year-over-year.

Research the owners of a company to detect possible bankruptcies, felonies, fraud, and other legal issues that could affect your business.

Use business verification services or business background reports from EntityCheck.

Keep in mind the context. For example, a single lien may not be alarming, but multiple filings, lawsuits, and frequent leadership turnover together signal real risk.

How to Register an Entity in Connecticut

Registering a business entity in Connecticut starts with conducting a name search to ensure your chosen name is available and does not infringe upon any other business's trademark. This is an essential step for compliance.

Setting up a business entity in Connecticut requires some paperwork, money, and time. Generally, anyone may take the following steps to set up a new business entity in the state:

Conduct a business entity search to ensure that the proposed name is available and distinguishable from any other business name.

Decide the type of business structure to run. This will determine the types of paperwork to file.

File Articles of Organization for the type of intended business structure with the Connecticut Secretary of the State.

File a report of Beneficial Owner Information (BOI) with the Financial Crimes Enforcement Network (FinCEN).

Submit a Business Tax Registration Application (if applicable) to obtain a Connecticut Tax Registration Number.

Obtain an employer identification number (EIN), also known as the federal tax identification number.

Register the business entity through myconneCT.

How Much Does It Cost to Start a Business in Connecticut?

Starting a business in Connecticut requires filing the correct paperwork for formation, which basically comes with specific fees, depending on the business structure being registered. The formation filing fees for each business structure are listed below:

Limited Liability Company - $120 and an optional $50 expedited fee.

Corporation - $250 for up to 20,000 authorized shares and an optional $50 expedited fee. Specific fees apply for every share over 20,000.

Non-profit Corporation - $50 and an optional expedited fee.

All fees are payable by check to the Secretary of the State. All other fees payable to the Connecticut Secretary of State when starting a business in the state are listed in the Business Service Division fee schedule.

Connecticut business naming guidelines require names to be unique and distinguishable from existing businesses, include specific words for certain entities, and avoid misleading or restricted terms. For legal entities such as LLCs and corporations, you must use a suffix such as "LLC" or "Corp." You must first check name availability through the Secretary of the State's business registry.

Connecticut's naming guidelines are as follows:

Uniqueness: The name must be distinguishable from any other registered business name in the state. Suffixes (like "Corp." or "LLC"), articles ("The", "A"), and conjunctions ("And" "&") are not considered when determining distinctiveness.

Misleading Terms: The name cannot imply a purpose for which the business is not authorized, such as using "bank" or "attorney" without the proper license.

Geographical Names: The name cannot misleadingly suggest a location in Connecticut if the business is not located within that geographical area.

LLCs: The name must include "limited liability company" or an abbreviation such as "LLC" or "L.L.C."

Corporations: The name must include "corporation", "company", "incorporated", "Societa per Azioni", or "limited", or an acceptable abbreviation such as "corp.", "co.", "inc.", "S.p.A.", or "ltd.".

Sole Proprietorships and General Partnerships: Must use the owner's or partners' surnames unless filing for a "doing business as" (DBA) name.

You can reserve a name for up to 120 days by filing a Name Reservation (Form RES/CAN) with the Secretary of the State and paying a fee.

FAQs

- How do I look up who owns an LLC in Connecticut (members vs. managers)?

To find an LLC's owner in Connecticut, use the Secretary of the State's online Business Records Search and look for the Articles of Organization or annual reports, which should list the members or managers. If the information isn't readily available in the initial search, you may need to submit a public information request or contact the registered agent listed on the entity's record.

- How can I find a corporation's officers and directors in the state?

You can find a corporation's officers and directors in Connecticut by using the Secretary of the State's Business Records Search tool on the Connecticut Business Services website. The search results will provide access to public information, including the Certificate of Incorporation or other filing documents that list this information.

- Are business owners' names public or private in Connecticut?

In Connecticut, the names of business owners are not automatically public, but the information is not entirely private either, as the state requires some disclosure for LLCs. While Connecticut law requires LLCs to maintain a private, internal list of members and managers, the state also requires you to list the LLC's organizer, who can be a third party, to maintain some anonymity. You can use the public search tools on the Connecticut Secretary of State's website to look up a business and find its principal name and other basic information.

You can also use EntityCheck's handy business search tool for finding directors, officers, and associates of a Hawaiian company.

- Where do I search official business records in the state?

You can search for official business records in Connecticut on the Connecticut Secretary of the State's website via the Business Records Search tool. You will need to go to the business.ct.gov portal, select "Business records search", and enter the business name to find information such as ownership, status, and filing details.

- How do I check if a business name is available or reserved in Connecticut?

To check if a business name is available in Connecticut, use the Connecticut Secretary of the State's Business Records Search tool. For name reservation, you can file a Company Name Reservation application through the Secretary of State if the name is available. You should also search the USPTO trademark database to check for existing federal trademarks, and conduct a domain name search for online availability.

- How can I view recent filings (Articles, amendments, mergers, annual/biennial reports) for a company in Connecticut?

You can view a Connecticut company's recent filings online through the Secretary of the State's Business Records Search tool. Go to the website, search for the business by name or filing number, and click on the company's name in the search results to see its information page. From there, you can select "View Filing History" to access and view the filings in PDF or HTML format.

- How do I get a Certificate of Good Standing/Existence in Connecticut?

To obtain a Certificate of Legal Existence (also known as a Certificate of Good Standing) for a Connecticut company in compliance with state filing requirements, order the certificate online from the Connecticut Secretary of the State's office via Business.CT.gov.

The cost is $50 for a standard certificate, and expedited options are available for an extra fee. First, ensure that the business is current on its annual report and has met all other statutory obligations.

- How do I obtain certified copies of formation documents and amendments in the state?

You can obtain certified copies of formation documents and amendments in Connecticut by requesting them online through your Business.CT.gov account or by mail. Online requests cost $55 for a certified copy. You can access them by searching for the business, selecting "View Filing History" to find the documents, then using the "Order Certified Copies" button. Alternatively, you can mail a written request to the Secretary of the State, which may take longer and may be restricted to black-and-white copies for older records.

- How do I search UCC (Uniform Commercial Code) liens against a company in Connecticut?

To search for a UCC lien against a company in Connecticut, visit the Connecticut Secretary of the State's website, find the UCC search section, and enter the company's legal name. You can typically perform a free online search through the state's business services portal to view active liens. For a thorough search, include the company's various names, such as "DBA" or "doing business as" names, as well as former names.

You can also use EntityCheck's UCC Filings search tool.

- What are the steps to register an LLC in Connecticut (forms, fees, timeline)?

To register an LLC in Connecticut, you must file a Certificate of Organization with the Secretary of the State, which costs a $120 filing fee, and you can do so online or by mail. The standard processing time is 3-5 business days, with expedited service available for an extra $50. Before filing, choose a unique business name, appoint a registered agent with a Connecticut address, and create an operating agreement. Also, be sure to obtain an EIN from the IRS if you plan to have employees.

- What are the steps to incorporate (C-Corp/S-Corp) in Connecticut?

To incorporate in Connecticut, you must choose a name, appoint a registered agent and directors, and file a Certificate of Incorporation with the Secretary of State. After this, you should create corporate bylaws, hold an organizational meeting, issue stock, and apply for an Employer Identification Number (EIN). To be an S-Corp, you must also file IRS Form 2553.

- Do I need a registered agent in the state, and who can serve as one?

Yes, Connecticut requires companies, such as LLCs and corporations, to have a registered agent. You can serve as your own agent if you are a Connecticut resident with a physical street address in the state, or you can hire a commercial registered agent service. Other options include appointing a trusted individual or an artificial legal entity, provided they have a physical address in Connecticut and are available during business hours.

- What annual reports, franchise/margin taxes, or license renewals are required in Connecticut?

Connecticut requires most formal business entities, including LLCs, stock corporations, and non-stock corporations, to file an annual report with the Secretary of the State, due by March 31 each year. The annual report costs $80. Additionally, certain business types, such as LLCs, LLPs, LPs, and S corporations, must pay a $250 annual Business Entity Tax (BET). Some corporations also have a one-time franchise tax at incorporation or upon increasing authorized shares. A franchise tax is paid at the time of incorporation and again for any increase in the number of authorized shares. Corporations may have to file a separate Corporation Franchise Tax Report (Form CT-3 or CT-4). Retailers selling taxable goods or services must have a permit that must be renewed. Additional specific professional or business licenses may have their own renewal requirements. Check with the relevant licensing agency for details.

- How long does state approval take in Connecticut, and are expedited options available?

For many Connecticut applications, standard approval takes 2-10 business days, depending on the filing method (online vs. mail) and the type of approval needed. Expedited options are frequently available for a fee, typically offering 24-hour processing for online submissions, though this service is not available for all applications (like the Controlled Substances Registration). LLCs filed online take 2-3 business days. LLCs filed by mail take 7-10 business days, plus mail time.

- Do I need to foreign-qualify to do business in Connecticut if my company is formed elsewhere?

Yes, your out-of-state company needs to foreign-qualify in Connecticut if you plan to "do business" there. This applies to most business structures, such as LLCs and corporations, and is required to operate legally in the state. Failure to foreign-qualify can result in penalties, such as being barred from suing in Connecticut courts or being subject to action by the attorney general.

- What activities count as "doing business" in the state?

While the specific definition can vary, typical activities that require a foreign qualification in Connecticut include:

Transacting a substantial amount of your ordinary business in the state.

Maintaining an active office in the state.

Manufacturing products in the state.

- How do I file a DBA/fictitious business name in Connecticut, and is county/city filing required?

To file a DBA in Connecticut, you must file a Trade Name Certificate with the town clerk in the town where the business is conducted, and county/city filing is not required. The form must include the company and owner's name and address, be signed and notarized, and submitted to the town clerk's office, along with a $10 fee. Partnerships that include the true last name of at least one partner, and Limited Partnerships registered with the Secretary of the State, do not require a trade name filing. After filing, you may need to publish a notice in a local newspaper within 30 days of filing.

- How do I change my company's name, address, officers, or members with the state?

To change your company's information in Connecticut, you can file an Amendment for business name, address, or other formation details, or an Interim Notice for officers or members, using the online portal or paper forms through the Connecticut Business Services website. Filing an Amendment typically incurs a fee, while an Interim Notice is often less expensive and is used for principal changes, such as officers or members.

- How do I reinstate or revive a company that's been administratively dissolved in Connecticut?

To reinstate a dissolved company in Connecticut, you must submit a reinstatement package, pay the required fees, and correct the issues that led to the dissolution, such as filing past-due annual reports and paying any outstanding taxes or penalties. You can typically request the necessary forms from the Connecticut Secretary of the State (SOTS), either by phone or by creating an account on the CT.gov business services website.

- Do I need to file Beneficial Ownership Information (BOI) with FinCEN, and how does that interact with Connecticut filings?

No, you likely do not need to file a Beneficial Ownership Information (BOI) report with FinCEN if your entity is a U.S. company, as FinCEN removed this requirement for all domestic reporting companies in March 2025. Therefore, there is no interaction with Connecticut filings related to the federal BOI reporting mandate.

- How to Conduct a Connecticut Business Entity Search

- Allowable Entity Types in Connecticut

- Why Search for a Connecticut Business Entity

- How to Search for Business Entities

- How EntityCheck Helps You Research Business Entities

- Alternative Resources Beyond the SOS (Secretary of State) Search

- How to Find the Owner of a Business Entity in Connecticut

- Additional Resources for Business Ownership Info

- Types of Owners and Their Roles

- Red Flags to Look for When Searching Business Entities

- Best Practices When Reviewing Business Entity Records

- How to Register an Entity in Connecticut

- How Much Does It Cost to Start a Business in Connecticut?

- FAQs

- EntityCheck in US States